What is the Robinhood 1099 Release Date?

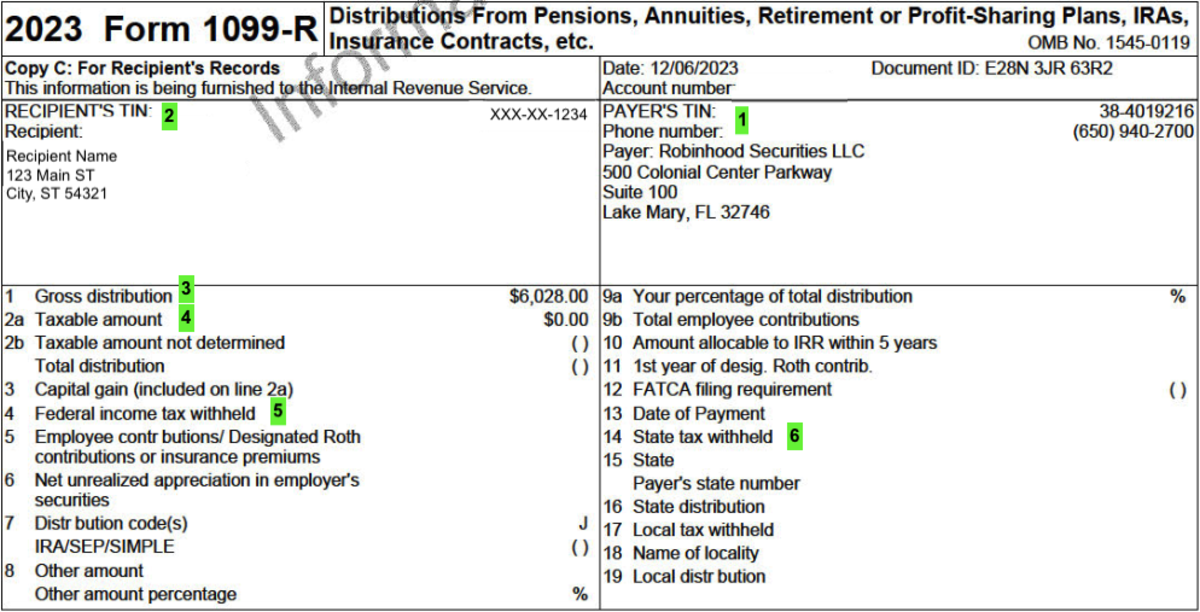

The Robinhood 1099 release date is the date on which Robinhood, a popular online brokerage, releases its 1099 tax forms to its users. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources.

The Robinhood 1099 release date is typically in late January or early February. For the 2023 tax year, Robinhood has announced that the 1099 release date will be January 31, 2023.

- Jeff Gennette The Loving Husband A Behindthescenes Look At His Personal Life

- Titanic Director James Wans Impressive Net Worth

It is important to note that the Robinhood 1099 release date is not the same as the tax filing deadline. The tax filing deadline for the 2023 tax year is April 18, 2024.

Once you have received your Robinhood 1099, you will need to use the information on the form to file your taxes. You can file your taxes online, by mail, or with the help of a tax professional.

Robinhood 1099 Release Date

The Robinhood 1099 release date is an important date for taxpayers who use Robinhood, a popular online brokerage. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources. The Robinhood 1099 release date is typically in late January or early February.

- The Evolution Of Apples Iconic Logo A History Of Innovation

- Indulge In The Flavors Of Wingstop The Ultimate Destination For Wing Lovers

- Date: January 31, 2023

- Importance: Tax reporting

- Filing: Online, mail, or tax professional

- Deadline: April 18, 2024

- Account: Robinhood

- Income: Dividends, interest

- Format: Digital or paper

- Availability: User account

These key aspects provide a concise overview of the Robinhood 1099 release date. Taxpayers should be aware of the release date and the importance of the 1099 form for tax reporting. The 1099 form can be used to file taxes online, by mail, or with the help of a tax professional. The tax filing deadline for the 2023 tax year is April 18, 2024. Robinhood users can access their 1099 form through their user account.

1. Date

The date January 31, 2023 is significant because it is the Robinhood 1099 release date. This means that Robinhood, a popular online brokerage, will release its 1099 tax forms to its users on this date. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources.

It is important for Robinhood users to be aware of the 1099 release date so that they can file their taxes accurately and on time. The tax filing deadline for the 2023 tax year is April 18, 2024. However, it is generally advisable to file your taxes as early as possible.

Once you have received your Robinhood 1099, you can use the information on the form to file your taxes online, by mail, or with the help of a tax professional. If you have any questions about your Robinhood 1099, you can contact Robinhood customer support for assistance.

2. Importance

The Robinhood 1099 release date is important because it marks the date on which Robinhood, a popular online brokerage, releases its 1099 tax forms to its users. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources. This information is essential for taxpayers to file their taxes accurately and on time.

Without the Robinhood 1099, taxpayers would not have a complete record of their income from Robinhood. This could lead to underreporting income, which could result in penalties from the IRS. Filing taxes late can also incur penalties and interest charges.

Therefore, it is important for Robinhood users to be aware of the 1099 release date and to file their taxes on time. The Robinhood 1099 release date is typically in late January or early February. For the 2023 tax year, the Robinhood 1099 release date is January 31, 2023.

3. Filing

The Robinhood 1099 release date is important because it marks the date on which Robinhood, a popular online brokerage, releases its 1099 tax forms to its users. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources. This information is essential for taxpayers to file their taxes accurately and on time.

Once taxpayers have received their Robinhood 1099, they can choose to file their taxes online, by mail, or with the help of a tax professional. Each method has its own advantages and disadvantages.

Filing online is the most convenient option for many taxpayers. There are a number of software programs and websites that allow taxpayers to file their taxes online. These programs can guide taxpayers through the process of filing their taxes and can help them to avoid making mistakes. However, filing online can be more expensive than other methods, and taxpayers may need to pay a fee to use a software program or website.

Filing by mail is a more traditional option, but it can be more time-consuming than filing online. Taxpayers who file by mail must complete a paper tax return and mail it to the IRS. The IRS will then process the return and send the taxpayer a refund or a bill.

Filing with the help of a tax professional can be a good option for taxpayers who have complex tax situations. Tax professionals can help taxpayers to understand the tax code and to make sure that they are claiming all of the deductions and credits that they are entitled to. However, hiring a tax professional can be expensive.

Ultimately, the best way to file taxes is the way that is most convenient and affordable for the taxpayer. Taxpayers should consider their own individual circumstances and choose the method that is best for them.4. Deadline

The Robinhood 1099 release date, January 31, 2023, is connected to the tax filing deadline, April 18, 2024. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources. Taxpayers need the information on the 1099 form to file their taxes accurately and on time.

If taxpayers do not receive their Robinhood 1099 by the release date, they should contact Robinhood customer support. Taxpayers can also access their 1099 form through their Robinhood user account.

Once taxpayers have received their Robinhood 1099, they can use the information on the form to file their taxes online, by mail, or with the help of a tax professional. It is important to file taxes on time to avoid penalties and interest charges.

5. Account

The Robinhood 1099 release date is significant for Robinhood account holders because it marks the date on which they can access their 1099 tax forms. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources. This information is essential for taxpayers to file their taxes accurately and on time.

- Tax Reporting: Robinhood account holders need the information on their 1099 form to report their income from Robinhood to the IRS. This includes income from dividends, interest, and other sources.

- Filing Methods: Robinhood account holders can use the information on their 1099 form to file their taxes online, by mail, or with the help of a tax professional. The method they choose will depend on their individual circumstances and preferences.

- Tax Deadlines: Robinhood account holders need to be aware of the tax filing deadline in order to file their taxes on time. The tax filing deadline for the 2023 tax year is April 18, 2024.

- Account Access: Robinhood account holders can access their 1099 form through their Robinhood user account. They can also contact Robinhood customer support if they have any questions about their 1099 form.

By understanding the connection between "Account: Robinhood" and "robinhood 1099 release date," Robinhood account holders can ensure that they file their taxes accurately and on time. This will help them to avoid penalties and interest charges, and it will also help them to get their tax refund as quickly as possible.

6. Income

The Robinhood 1099 release date is significant for individuals who earn income from dividends and interest through their Robinhood account. The 1099 form is a tax document that reports this type of income, which is essential for accurate tax filing.

- Reporting Dividend Income: Dividends are payments made by companies to their shareholders, and they are considered taxable income. The Robinhood 1099 form will include information on the total amount of dividends earned during the tax year.

- Reporting Interest Income: Interest is earned when money is deposited in a savings account or other interest-bearing account. The Robinhood 1099 form will include information on the total amount of interest earned during the tax year.

- Tax Implications: Dividends and interest are taxed at different rates depending on the individual's tax bracket. The Robinhood 1099 form will help taxpayers determine how much tax they owe on this type of income.

- Filing Methods: Individuals can use the information on their Robinhood 1099 form to file their taxes online, by mail, or with the help of a tax professional. The method they choose will depend on their individual circumstances and preferences.

By understanding the connection between "Income: Dividends, interest" and "robinhood 1099 release date," individuals can ensure that they report their income accurately and file their taxes on time. This will help them avoid penalties and interest charges, and it will also help them to get their tax refund as quickly as possible.

7. Format

The Robinhood 1099 release date is significant for individuals who need to access their 1099 tax forms. The format of the 1099 form, whether digital or paper, is an important consideration for taxpayers.

Digital 1099 forms are available through the Robinhood user account. Taxpayers can access their digital 1099 form by logging into their account and navigating to the "Tax Documents" section. Digital 1099 forms are convenient and easy to access, and they can be downloaded and printed if necessary.

Paper 1099 forms are mailed to the address on file with Robinhood. Taxpayers who prefer to receive a paper 1099 form should ensure that their address is up to date in their Robinhood account. Paper 1099 forms are typically mailed in late January or early February.

The format of the 1099 form, whether digital or paper, does not affect the accuracy or validity of the information on the form. Taxpayers can use either a digital or paper 1099 form to file their taxes.

8. Availability

The connection between "Availability: User account" and "robinhood 1099 release date" is significant for taxpayers who use Robinhood, a popular online brokerage, to manage their investments. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources. Robinhood users can access their 1099 forms through their user account, making it easy to retrieve and file their taxes.

- Convenience: Robinhood users can access their 1099 forms online anytime, anywhere. This convenience allows taxpayers to file their taxes on their own time and at their own pace.

- Security: Robinhood uses industry-leading security measures to protect its users' personal and financial information. This ensures that taxpayers' 1099 forms are safe and secure.

- Accuracy: Robinhood 1099 forms are generated electronically, which helps to ensure accuracy. This reduces the risk of errors that could delay a tax refund or result in penalties.

- Accessibility: Robinhood users can access their 1099 forms even if they have closed their Robinhood account. This ensures that taxpayers can always access their tax documents, regardless of their account status.

By understanding the connection between "Availability: User account" and "robinhood 1099 release date," taxpayers can ensure that they have timely access to their tax documents and can file their taxes accurately and on time.

FAQs

This section addresses frequently asked questions regarding the Robinhood 1099 release date and its significance for taxpayers.

Question 1: When is the Robinhood 1099 release date?

The Robinhood 1099 release date is typically in late January or early February. For the 2023 tax year, the Robinhood 1099 release date is January 31, 2023.

Question 2: Why is the Robinhood 1099 release date important?

The Robinhood 1099 release date is important because it marks the date on which Robinhood, a popular online brokerage, releases its 1099 tax forms to its users. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources. This information is essential for taxpayers to file their taxes accurately and on time.

Question 3: How can I access my Robinhood 1099 form?

Robinhood users can access their 1099 forms through their user account. To do this, log into your Robinhood account and navigate to the "Tax Documents" section. You can download and print your 1099 form from there.

Question 4: What should I do if I don't receive my Robinhood 1099 form by the release date?

If you do not receive your Robinhood 1099 form by the release date, you should contact Robinhood customer support. You can also access your 1099 form through your Robinhood user account.

Question 5: What is the tax filing deadline?

The tax filing deadline for the 2023 tax year is April 18, 2024. However, it is generally advisable to file your taxes as early as possible.

These FAQs provide a summary of key information regarding the Robinhood 1099 release date. Taxpayers should be aware of the release date and the importance of filing their taxes accurately and on time.

If you have any further questions, please visit the Robinhood Help Center or contact Robinhood customer support.

Conclusion

The Robinhood 1099 release date is an important date for taxpayers who use Robinhood, a popular online brokerage, to manage their investments. The 1099 form is a tax document that reports income earned from dividends, interest, and other sources. This information is essential for taxpayers to file their taxes accurately and on time.

Robinhood users should be aware of the 1099 release date and should access their 1099 form through their user account. The tax filing deadline for the 2023 tax year is April 18, 2024. However, it is generally advisable to file your taxes as early as possible.

By understanding the importance of the Robinhood 1099 release date and by filing their taxes accurately and on time, taxpayers can avoid penalties and interest charges and can get their tax refund as quickly as possible.

Detail Author:

- Name : Miss Rosa Zemlak DDS

- Username : moen.julio

- Email : ymorar@gmail.com

- Birthdate : 2006-12-26

- Address : 36612 Lilyan Gardens Apt. 769 Lake Coltland, UT 63645

- Phone : 973.587.0817

- Company : Kulas, Jast and Walker

- Job : Infantry

- Bio : Pariatur id molestiae magnam ipsa ullam vel. Non quo architecto facere vero minus corrupti similique officiis. Aut non nemo velit. Culpa voluptates excepturi doloribus sit corporis officiis quia.

Socials

linkedin:

- url : https://linkedin.com/in/nat.mayert

- username : nat.mayert

- bio : Neque qui nostrum aut voluptatum.

- followers : 6172

- following : 200

tiktok:

- url : https://tiktok.com/@nat_mayert

- username : nat_mayert

- bio : Tempora nesciunt fugiat animi quidem dolor et.

- followers : 2540

- following : 2310

facebook:

- url : https://facebook.com/nat_mayert

- username : nat_mayert

- bio : Quas repellendus et qui consequatur ullam illum.

- followers : 4453

- following : 1331