What is a bank branch?

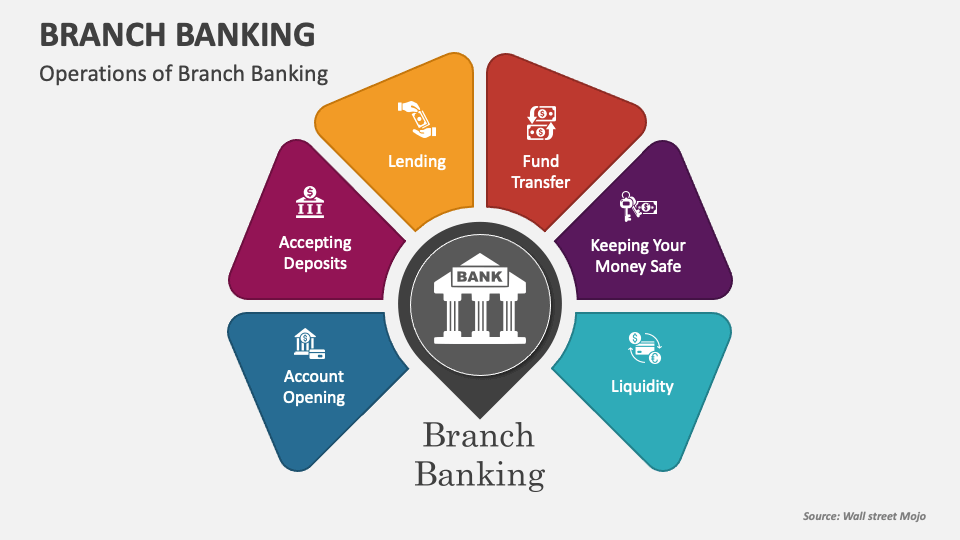

A bank branch is a physical location where a bank conducts its business with customers. Bank branches offer a variety of services, including:

- Accepting deposits

- Cashing checks

- Issuing loans

- Providing financial advice

Importance of bank branches

- The Legendary Jerry Buss A History Of The Lakers Dynasty

- Who Started Chippendales Uncovering The Origins Of The Male Revue Empire

Bank branches play an important role in the economy by providing financial services to individuals and businesses. They help to facilitate commerce and economic growth by providing access to capital and other financial services. Bank branches also provide a safe and secure place for people to store their money and valuables.

Bank Branches

Bank branches are physical locations where banks conduct business with customers. They provide a variety of services, including accepting deposits, cashing checks, issuing loans, and providing financial advice. Bank branches are an important part of the banking system, as they provide customers with a convenient way to access their money and conduct their banking business.

- Location: Bank branches can be found in a variety of locations, including urban, suburban, and rural areas.

- Services: Bank branches offer a wide range of services, including:

- Accepting deposits

- Cashing checks

- Issuing loans

- Providing financial advice

- Staff: Bank branches are staffed with trained professionals who can assist customers with their banking needs.

- Hours: Bank branches typically have regular business hours, but some branches may offer extended hours or weekend hours.

- Security: Bank branches are typically secure locations, with security measures in place to protect customers and their money.

- Convenience: Bank branches provide customers with a convenient way to access their money and conduct their banking business.

- Personalization: Bank branches allow customers to build relationships with their bankers, which can lead to personalized service.

- Community involvement: Bank branches are often involved in their local communities, supporting local businesses and organizations.

Bank branches play an important role in the banking system and provide a variety of benefits to customers. They are a convenient and secure way to access banking services, and they can also provide personalized service and support to customers.

- The Ultimate Guide To Car Step In Shark Tank History Hottest Models And Investment Updates

- Is Phil Rosenthal A Zionist Exploring The History And Controversy

1. Location

The location of bank branches is an important factor in their ability to serve customers. Bank branches in urban areas are typically located in high-traffic areas, such as downtown or near shopping malls. This makes it convenient for customers to access their banking services. Bank branches in suburban areas are typically located in residential areas or near major roads. This makes it convenient for customers to bank near their homes or workplaces. Bank branches in rural areas are typically located in small towns or villages. This provides access to banking services for customers who live in remote areas.

The location of bank branches is also important for the banks themselves. Banks want to locate their branches in areas where they can attract the most customers. This means that banks will often locate their branches in areas with a high population density or in areas with a high concentration of businesses.

The location of bank branches has a significant impact on the banking industry. By understanding the location of bank branches, banks can better serve their customers and grow their businesses.

2. Services

Accepting deposits is one of the most important services that bank branches offer. Deposits are the foundation of the banking system, as they provide the banks with the they need to lend out to businesses and consumers. Without deposits, banks would not be able to function.

There are many different types of deposits that bank branches can accept, including checking deposits, savings deposits, and money market deposits. Each type of deposit has its own unique set of features and benefits. Checking deposits are the most common type of deposit, and they allow customers to access their money easily and quickly. Savings deposits typically earn a higher interest rate than checking deposits, but they may have restrictions on how often customers can access their money. Money market deposits are a type of high-yield deposit that offers a higher interest rate than checking and savings deposits, but they may have stricter requirements, such as a minimum balance.

Bank branches play a vital role in the banking system by accepting deposits. Deposits provide banks with the funds they need to lend out to businesses and consumers, which helps to fuel economic growth. Bank branches also provide a convenient and secure place for customers to store their money.

3. Cashing checks

Cashing checks is an important service offered by bank branches. Checks are a common form of payment, and people often need to cash checks to get the money they need to pay bills, buy groceries, or make other purchases. Bank branches provide a safe and convenient place to cash checks, and they can also provide other services, such as check cashing fees and check cashing limits.

- Convenience: Bank branches are conveniently located in many communities, making it easy for people to cash their checks. Bank branches also typically have extended hours, so people can cash their checks even if they work during the day.

- Security: Bank branches are secure places to cash checks. Bank branches have security measures in place to protect customers from fraud and theft. Bank branches also have trained staff who can help customers to identify and avoid counterfeit checks.

- Fees: Bank branches may charge a fee to cash checks. The fee varies depending on the bank and the type of check. Some banks offer free check cashing to their customers, while other banks charge a fee for each check cashed.

- Limits: Bank branches may have limits on the amount of money that they will cash per day or per week. These limits are in place to protect the bank from fraud and theft. Bank branches may also have limits on the types of checks that they will cash. For example, some banks may not cash checks that are drawn on out-of-state banks.

Cashing checks is an important service offered by bank branches. Bank branches provide a safe and convenient place to cash checks, and they can also provide other services, such as check cashing fees and check cashing limits. By understanding the different factors that affect check cashing, consumers can make informed decisions about where to cash their checks.

4. Issuing loans

Issuing loans is an essential service provided by banks and other financial institutions. Loans allow individuals and businesses to borrow money for a variety of purposes, such as buying a home, starting a business, or consolidating debt. Bank branches play a vital role in the loan process, as they provide a convenient and secure place for customers to apply for and receive loans.

- Loan applications: Bank branches are where most loan applications are initiated. Customers can meet with a loan officer to discuss their loan needs and complete the necessary paperwork. Loan officers can also provide customers with information about different loan products and help them to choose the best loan for their needs.

- Loan approvals: Loan officers at bank branches have the authority to approve loans up to a certain amount. This makes the loan process faster and more convenient for customers, as they do not have to wait for a decision from a central underwriting department.

- Loan disbursements: Once a loan is approved, the funds are typically disbursed through the customer's bank account. Bank branches can provide customers with convenient access to their loan funds, as they can withdraw the money directly from their account.

- Loan servicing: Bank branches can also provide loan servicing, such as accepting loan payments and providing customers with statements. This makes it easy for customers to manage their loans and keep track of their payments.

Issuing loans is an important service provided by bank branches. Bank branches provide a convenient and secure place for customers to apply for and receive loans, and they can also provide loan servicing. By understanding the role of bank branches in the loan process, customers can make informed decisions about how to finance their needs.

5. Providing financial advice

Providing financial advice is an essential service offered by bank branches. Financial advisors can help customers with a variety of financial planning needs, such as:

- Creating a budget

- Saving for retirement

- Investing for the future

- Planning for major life events, such as buying a home or getting married

- Managing debt

Financial advisors can also provide guidance on specific financial products and services, such as loans, insurance, and investments. By providing financial advice, bank branches can help customers to make informed decisions about their finances and achieve their financial goals.

There are many benefits to receiving financial advice from a bank branch. First, financial advisors are trained professionals who have the knowledge and experience to help customers make sound financial decisions. Second, financial advisors can provide objective advice that is not influenced by sales goals or commissions. Third, financial advisors can help customers to develop a personalized financial plan that meets their specific needs and goals.

If you are looking for financial advice, your bank branch is a great place to start. Financial advisors at bank branches can provide you with the guidance and support you need to make informed financial decisions and achieve your financial goals.

6. Staff

The staff at a bank branch are the individuals who provide face-to-face customer service to customers. These staff members are trained professionals who are knowledgeable about the bank's products and services, and they are able to assist customers with a wide range of banking needs. Common tasks that bank branch staff perform include:

- Opening new accounts

- Processing deposits and withdrawals

- Cashing checks

- Issuing loans

- Providing financial advice

7. Hours

The hours of operation for bank branches vary depending on the bank and the location of the branch. Most bank branches are open during regular business hours, which are typically Monday through Friday from 9:00 am to 5:00 pm. However, some bank branches may offer extended hours or weekend hours for the convenience of customers.

There are several reasons why a bank branch may offer extended hours or weekend hours. One reason is to accommodate customers who work during the day and cannot visit the bank during regular business hours. Another reason is to serve customers who live in rural areas or who have difficulty traveling to the bank during regular business hours. Additionally, some bank branches offer extended hours or weekend hours to meet the needs of customers who are traveling or who have other commitments during the week.

The availability of extended hours or weekend hours can be a major convenience for customers. It allows customers to conduct their banking business at a time that is convenient for them. This can be especially important for customers who have busy schedules or who live in areas where there are few bank branches.

If you are looking for a bank branch that offers extended hours or weekend hours, you should contact your bank or visit the bank's website. You can also use a search engine to find bank branches in your area that offer extended hours or weekend hours.

8. Security

Security is a top priority for bank branches. This is because bank branches are responsible for safeguarding large amounts of money and sensitive customer information. To protect customers and their money, bank branches implement a variety of security measures, including:

- Surveillance cameras: Bank branches are typically equipped with surveillance cameras to deter crime and monitor activity.

- Security guards: Many bank branches have security guards on duty to protect customers and employees.

- Alarms: Bank branches are equipped with alarms to alert authorities in the event of a robbery or other security breach.

- Safes: Bank branches have safes to store money and other valuables.

- Access control: Bank branches have access control systems to restrict access to unauthorized individuals.

These security measures make bank branches a safe place to conduct banking business. Customers can rest assured that their money and personal information are protected.

The security of bank branches is essential for the financial system. Bank branches are where people deposit their money and conduct their banking business. If bank branches were not secure, people would not trust them with their money. This would have a devastating impact on the economy.

The security of bank branches is also important for public safety. Bank branches are often targets for criminals. If bank branches were not secure, criminals would be more likely to rob them. This would put the public at risk.

The security of bank branches is a complex issue. There is no single solution that will work for all bank branches. However, by implementing a variety of security measures, bank branches can create a safe environment for customers and employees.

Frequently Asked Questions about Bank Branches

Bank branches are physical locations where banks conduct business with customers. They offer a variety of services, including accepting deposits, cashing checks, issuing loans, and providing financial advice. Bank branches play an important role in the banking system, as they provide customers with a convenient way to access their money and conduct their banking business.

Question 1: What is the purpose of a bank branch?

Answer: Bank branches serve a variety of purposes, including providing customers with a convenient way to access their money, conduct their banking business, and obtain financial advice.

Question 2: What services do bank branches offer?

Answer: Bank branches offer a wide range of services, including accepting deposits, cashing checks, issuing loans, providing financial advice, and more.

Question 3: Are bank branches safe?

Answer: Yes, bank branches are typically secure locations, with security measures in place to protect customers and their money.

Question 4: What are the benefits of using a bank branch?

Answer: There are many benefits to using a bank branch, including convenience, security, and access to a wide range of financial services.

Question 5: How do I find a bank branch near me?

Answer: You can find a bank branch near you by using a search engine or by visiting the website of your bank.

Summary of key takeaways or final thought: Bank branches play an important role in the banking system. They offer a variety of services, including accepting deposits, cashing checks, issuing loans, and providing financial advice. Bank branches are typically secure locations, and they provide customers with a convenient way to access their money and conduct their banking business.

Transition to the next article section: Learn more about the services offered by bank branches in the next section.

Conclusion

Bank branches are a vital part of the banking system. They offer a variety of services that are essential for businesses and consumers, including accepting deposits, cashing checks, issuing loans, and providing financial advice. Bank branches also play an important role in the local economy, providing jobs and supporting local businesses.

The future of bank branches is uncertain. The rise of online and mobile banking has led some to predict that bank branches will eventually become obsolete. However, bank branches still offer a number of advantages over online and mobile banking, including the ability to provide face-to-face customer service and access to a wider range of financial services. As a result, it is likely that bank branches will continue to play an important role in the banking system for years to come.

Detail Author:

- Name : Isom Lesch

- Username : ledner.alberto

- Email : okuneva.jefferey@kautzer.com

- Birthdate : 2001-06-30

- Address : 583 Toy Ports Apt. 871 West Josefa, GA 62889-7505

- Phone : +1.217.948.8799

- Company : Kozey Ltd

- Job : Social Worker

- Bio : Impedit est temporibus illum aut laborum. Autem et nam alias in. Possimus reiciendis non ut molestiae. Qui eos repellendus qui beatae accusamus asperiores.

Socials

tiktok:

- url : https://tiktok.com/@margarita_o'kon

- username : margarita_o'kon

- bio : Aut eum quia provident accusamus sed dolor omnis. Velit minus quidem sunt.

- followers : 6366

- following : 2422

facebook:

- url : https://facebook.com/margarita2753

- username : margarita2753

- bio : Quasi est numquam veniam dolor ut nam.

- followers : 1156

- following : 1038