What is a Bank Branch Number?

A bank branch number is a unique identifier assigned to each branch of a bank. It is used to identify the specific branch where an account is held or a transaction is taking place.

Bank branch numbers are typically used in conjunction with other account information, such as the account number and routing number, to process transactions and ensure that funds are sent to the correct destination.

- Lawrence Jones Fox News Host Uncovering His Wife And Personal Life

- Find Out The Value Of A 1919 Penny Today

The importance of bank branch numbers cannot be overstated. They play a vital role in the smooth functioning of the banking system and help to ensure that financial transactions are processed accurately and efficiently.

Here are some of the benefits of using bank branch numbers:

- They help to identify the specific branch where an account is held or a transaction is taking place.

- They help to ensure that funds are sent to the correct destination.

- They help to prevent fraud and identity theft.

Bank branch numbers are an essential part of the banking system. They play a vital role in the smooth functioning of financial transactions and help to ensure that your money is safe and secure.

Bank Branch Number

Bank branch numbers are essential for the smooth functioning of the banking system. They play a vital role in ensuring that financial transactions are processed accurately and efficiently.

- Unique identifier: Each bank branch has a unique branch number that distinguishes it from all other branches of the same bank.

- Account identification: The branch number is used to identify the specific branch where an account is held.

- Transaction processing: The branch number is used to process transactions and ensure that funds are sent to the correct destination.

- Fraud prevention: Branch numbers help to prevent fraud and identity theft by ensuring that transactions are only processed from authorized branches.

- Security: Branch numbers help to keep your money safe and secure by ensuring that only authorized individuals have access to your account information.

- Convenience: Branch numbers make it easy and convenient to access your account information and conduct transactions.

In conclusion, bank branch numbers are essential for the security, accuracy, and efficiency of the banking system. They play a vital role in protecting your money and ensuring that your financial transactions are processed smoothly.

1. Unique identifier

The unique identifier plays a crucial role in the overall functionality of bank branch numbers. It allows each branch to be easily identified and distinguished from all other branches of the same bank. This unique identification is essential for efficient transaction processing, fraud prevention, and overall security within the banking system.

For instance, when a customer initiates a financial transaction, the branch number associated with their account is used to route the transaction to the correct branch for processing. This ensures that the transaction is processed accurately and efficiently, reducing the risk of delays or errors.

Moreover, the unique identifier plays a vital role in preventing fraud and identity theft. By ensuring that transactions can only be processed from authorized branches, banks can mitigate the risk of unauthorized access to customer accounts and fraudulent activities.

In summary, the unique identifier assigned to each bank branch is a critical component of bank branch numbers. It enables efficient transaction processing, enhances security measures, and contributes to the overall integrity of the banking system.

2. Account identification

The connection between account identification and bank branch numbers is crucial for understanding the functionality and importance of bank branch numbers in the banking system.

- Identifying account location: The branch number serves as a unique identifier for each bank branch, allowing banks to pinpoint the specific branch where an account is held. This is particularly important for banks with multiple branches across different locations or regions.

- Transaction routing: The branch number plays a vital role in routing transactions to the correct branch for processing. When a customer initiates a transaction, the branch number associated with their account helps ensure that the transaction is directed to the appropriate branch for execution.

- Fraud prevention: By identifying the specific branch where an account is held, the branch number aids in fraud prevention efforts. Banks can monitor transactions originating from specific branches and identify any suspicious or unauthorized activities.

- Customer convenience: The branch number provides customers with a convenient way to identify the branch associated with their account. This information is often displayed on bank statements, checks, and other banking documents, allowing customers to easily locate the branch for in-person transactions or inquiries.

In summary, the connection between account identification and bank branch numbers is fundamental to the efficient functioning of the banking system. It enables accurate transaction processing, enhances fraud prevention measures, and provides convenience to customers.

3. Transaction processing

In the realm of banking operations, the utilization of bank branch numbers plays a pivotal role in transaction processing, ensuring the seamless flow of funds to their intended recipients.

- Identification and Verification: The branch number acts as a unique identifier for each branch within a bank's network. When a transaction is initiated, the associated branch number verifies the legitimacy of the transaction and the existence of the specified account.

- Routing and Execution: Once the transaction is validated, the branch number serves as a routing mechanism, directing the transaction to the appropriate branch for execution. This ensures that funds are transferred to the correct account and the transaction is completed successfully.

- Fraud Prevention: Bank branch numbers contribute to fraud prevention by providing an additional layer of security. By verifying the branch number associated with a transaction, banks can identify and flag suspicious activities that may indicate fraudulent attempts.

- Regulatory Compliance: Adhering to regulatory requirements, banks leverage branch numbers to maintain accurate and detailed records of all transactions. This facilitates compliance with anti-money laundering and other financial regulations.

In conclusion, the connection between transaction processing and bank branch numbers is vital for the efficient, secure, and compliant functioning of banking operations. It underpins the integrity of financial transactions, safeguarding customers' funds and upholding regulatory standards.

4. Fraud prevention

Bank branch numbers play a crucial role in preventing fraud and identity theft by ensuring that transactions are only processed from authorized branches. This is achieved through several key mechanisms:

- Verification of Branch Identity: When a transaction is initiated, the bank branch number associated with the account is verified to ensure that the transaction is originating from a legitimate branch.

- Restriction of Unauthorized Access: Bank branch numbers serve as a security measure to restrict unauthorized access to customer accounts. By limiting transaction processing to authorized branches, banks can prevent fraudsters from gaining access to sensitive account information and initiating fraudulent transactions.

- Detection of Suspicious Activity: Banks closely monitor transactions originating from specific branches to identify any suspicious or unusual patterns. By analyzing branch-level transaction data, banks can detect potential fraud attempts and take appropriate action to protect customer accounts.

The connection between fraud prevention and bank branch numbers is critical for maintaining the security and integrity of banking systems. By ensuring that transactions are only processed from authorized branches, banks can significantly reduce the risk of fraud and identity theft, safeguarding customer funds and protecting the financial system as a whole.

In conclusion, the role of bank branch numbers in fraud prevention is a vital aspect of banking operations. By verifying branch identity, restricting unauthorized access, and detecting suspicious activity, bank branch numbers contribute to a secure and trustworthy banking environment.

5. Security

Bank branch numbers play a crucial role in maintaining the security of your financial information and preventing unauthorized access to your account. They serve as an additional layer of protection, ensuring that only authorized individuals can access and manage your funds.

- Verification of Branch Identity: When you conduct a transaction, the bank branch number associated with your account is verified to ensure that the transaction is originating from a legitimate branch. This helps prevent fraudsters from gaining access to your account information and initiating unauthorized transactions.

- Restriction of Unauthorized Access: Bank branch numbers serve as a security measure to restrict unauthorized access to customer accounts. By limiting transaction processing to authorized branches, banks can prevent fraudsters from gaining access to sensitive account information and initiating fraudulent transactions.

- Detection of Suspicious Activity: Banks closely monitor transactions originating from specific branches to identify any suspicious or unusual patterns. By analyzing branch-level transaction data, banks can detect potential fraud attempts and take appropriate action to protect customer accounts.

- Compliance with Regulations: Bank branch numbers also play a role in complying with regulations aimed at preventing financial crime. By maintaining accurate records of transactions associated with each branch, banks can more easily comply with anti-money laundering and other financial regulations.

In conclusion, bank branch numbers are an essential security measure that helps protect your financial information and prevent unauthorized access to your account. By verifying branch identity, restricting unauthorized access, detecting suspicious activity, and complying with regulations, bank branch numbers contribute to a secure and trustworthy banking environment.

6. Convenience

The convenience provided by bank branch numbers is a crucial component of their overall functionality and value to customers. It enables easy access to account information and the ability to conduct transactions seamlessly.

The ease of access provided by branch numbers is particularly important in today's fast-paced digital environment. Customers can quickly and conveniently check their account balances, transfer funds, and conduct other transactions without having to visit a physical branch.

Moreover, branch numbers play a vital role in facilitating transactions across different channels. For instance, customers can use their branch number to make online payments, set up automatic bill payments, and access mobile banking services.

In conclusion, the convenience offered by bank branch numbers is a key factor in their widespread adoption and popularity. It empowers customers with the ability to manage their finances and conduct transactions easily and efficiently.

Frequently Asked Questions about Bank Branch Numbers

Bank branch numbers play a crucial role in the banking system, enabling efficient transaction processing and ensuring the security of customer accounts. Here are answers to some common questions about bank branch numbers:

Question 1: What is a bank branch number?A bank branch number is a unique identifier assigned to each branch of a bank. It helps identify the specific branch where an account is held or a transaction is taking place.

Question 2: Why are bank branch numbers important?Bank branch numbers are essential for ensuring accurate and efficient transaction processing. They also help prevent fraud and identity theft by restricting unauthorized access to customer accounts.

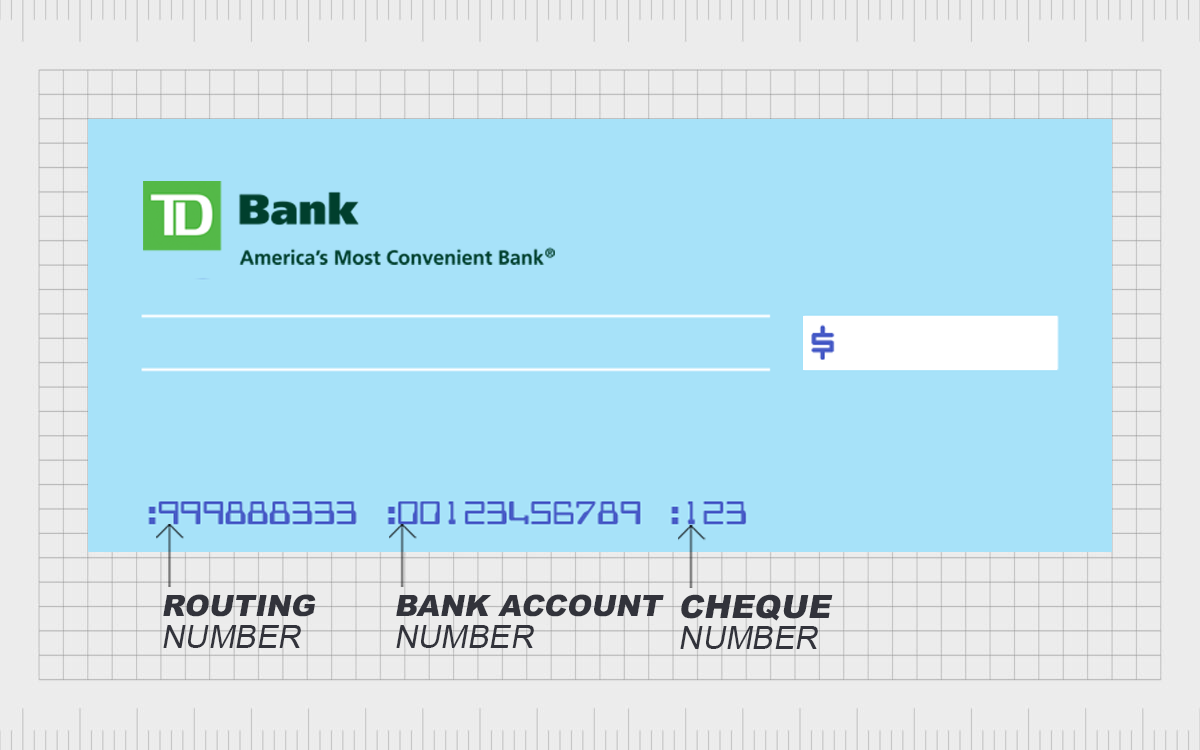

Question 3: How can I find my bank branch number?Your bank branch number can typically be found on your bank statements, checks, or passbook.

Question 4: What if I don't know my bank branch number?If you don't know your bank branch number, you can contact your bank's customer service or visit your local branch to inquire.

Question 5: Are bank branch numbers the same as routing numbers?No, bank branch numbers and routing numbers are not the same. A routing number identifies the specific financial institution, while a branch number identifies the specific branch within that financial institution.

In summary, bank branch numbers are essential for the smooth functioning of the banking system. They help ensure the accuracy, efficiency, and security of financial transactions.

Should you have any further questions about bank branch numbers, please do not hesitate to contact your bank or refer to their official website for more information.

Conclusion on Bank Branch Number

In conclusion, bank branch numbers play a crucial role in the banking system, enabling efficient and secure financial transactions. They serve as unique identifiers for each branch, facilitating accurate transaction processing and preventing fraud. Bank branch numbers are essential for account identification, ensuring that funds are transferred to the correct destination.

Moreover, bank branch numbers enhance the security of banking operations by restricting unauthorized access to customer accounts and monitoring transactions for suspicious activities. They also provide convenience to customers, allowing them to easily access their account information and conduct transactions through multiple channels.

As the banking landscape continues to evolve, bank branch numbers will remain essential for maintaining the integrity and efficiency of financial transactions. They will continue to play a vital role in safeguarding customer funds and ensuring the smooth functioning of the banking system.

![How to find your Bank Routing Number in Canada [2024] Protect Your Wealth](https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_1024,h_581/https://protectyourwealth.ca/wp-content/uploads/2022/03/Sample-CIBC-Cheque-1024x581.png)

Detail Author:

- Name : Alfred Bergstrom III

- Username : zoie94

- Email : missouri.price@gmail.com

- Birthdate : 1994-10-21

- Address : 15106 Aryanna Turnpike Suite 639 Manteside, DC 96082-7386

- Phone : (806) 285-6878

- Company : Beahan, Turcotte and Beer

- Job : Precision Lens Grinders and Polisher

- Bio : Placeat unde iusto consectetur unde quas cumque. Laborum aut nostrum expedita eum. Nam et exercitationem autem praesentium vel non inventore.

Socials

facebook:

- url : https://facebook.com/kameronstark

- username : kameronstark

- bio : Sed natus illum delectus qui non. Adipisci aliquid veniam sunt tenetur hic.

- followers : 6853

- following : 2836

linkedin:

- url : https://linkedin.com/in/kameron_dev

- username : kameron_dev

- bio : Corrupti ducimus quod asperiores.

- followers : 5163

- following : 331

instagram:

- url : https://instagram.com/kameron437

- username : kameron437

- bio : Laudantium consequatur et in at cumque eum. Ea quis impedit doloribus voluptatibus aut illum.

- followers : 2338

- following : 2942

tiktok:

- url : https://tiktok.com/@kstark

- username : kstark

- bio : Quaerat velit hic aut consequatur nihil.

- followers : 6660

- following : 1672